Compound interest formula with monthly contributions

PMT the monthly payment deposit. To begin calculate the interest on the principal first using.

Why Do We Add 1 To Certain Ratios Or Formulas For Example Financial Ratios Compound Interest Formula Etc Quora

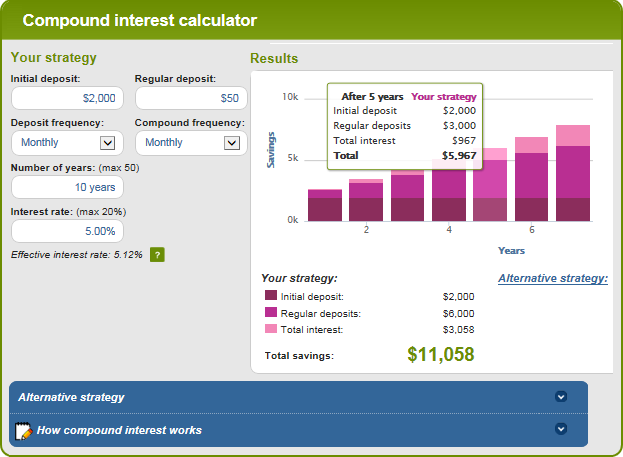

This is a compound interest calculator savers can use to get an idea of how.

. The more money you can deposit on a frequent and. Calculate interest compounding annually for year one. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term.

The interest can be compounded annually semiannually quarterly monthly or daily. This lets us find the most appropriate writer for any type of assignment. Finally we change from annual contributions and compounding to monthly.

The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. Compound interest is calculated using the compound interest formula. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon.

P the principal investment amount the initial deposit or loan amount also known as present value or PV. Online compounding calculators you find online will offer all the factors and variables described above in addition to contributions which are vital to the success of your investment strategy. Adjust the lump sum payment regular contribution figures term and annual interest rate.

The other parameters stay the same. Treasury savings bonds pay out interest each year based on their interest rate and current value. It is distinct from a fee which the borrower may pay the lender or some third party.

Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. The compounding frequency is the number of times per year or rarely another unit of time the accumulated interest is paid out or capitalized credited to the account on a regular basis. R is also known as rate of return.

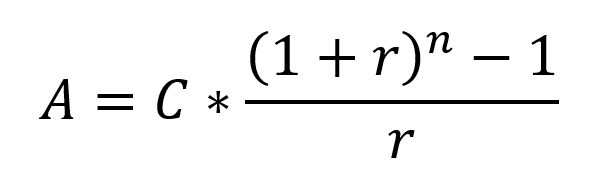

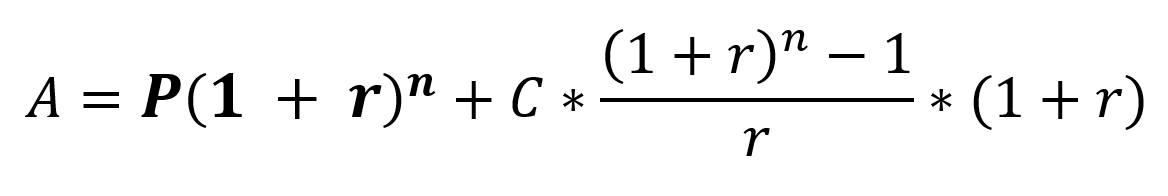

An easy approach is to separate the compounding interest for the principal from that of the monthly contributions or paymentsPMT. The time value of money is among the factors considered when weighing the opportunity costs of spending rather than saving or investing. And the selfdiscipline needed to leave it there to.

Years at a given interest. A 90 percent of the first 996 of average indexed monthly earnings plus. If people begin making regular investment contributions early on in their lives they can see significant growth in.

This formula works best for interest rates between 6 and 10 but it should also work reasonably well for anything below 20. It may be seen as an implication of the later-developed concept of time preference. Determine all of the variables youll need and plug them into the formula before crunching the numbers.

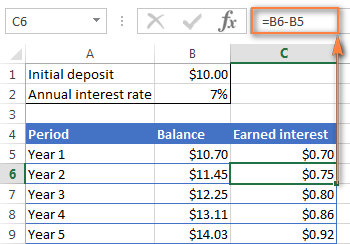

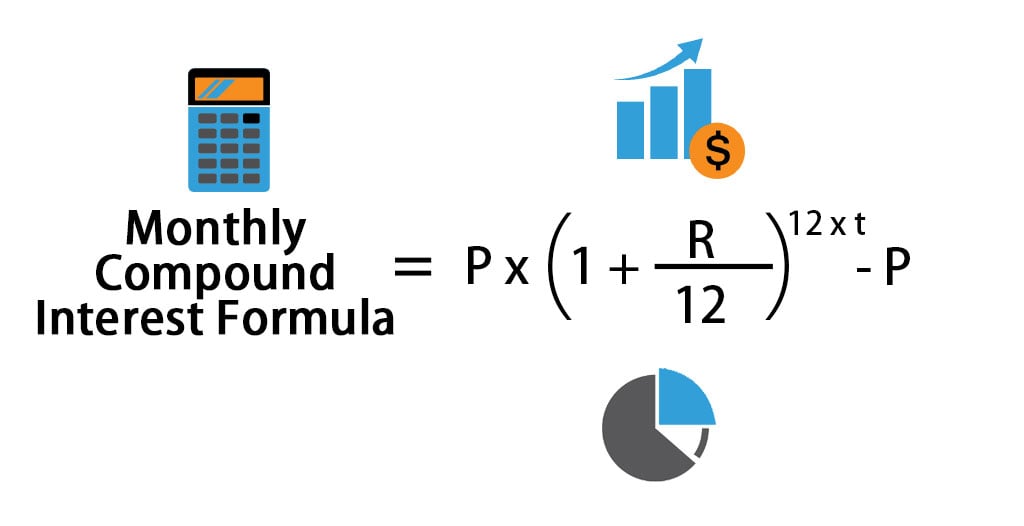

P 1 R N N T. N the number compounding periods per year n 1 for annually n 12 for monthly etc. R the annual interest rate expressed in decimal form decimal 100.

Thought to have. I total compound interest. Assume that you own a 1000 6 savings bond issued by the US Treasury.

The average monthly Social Security benefit for December 2019 was 1382. The Compound Interest Formula. The frequency could be yearly half-yearly quarterly monthly weekly daily or continuously or not at all until maturity.

Teaser raters on adjustable mortgages APR rates on credit cards which dont highlight other fees or the compounding effects and secured credit cards which have an effective APR of above 100 after paying for the membership fee - and whats worse is that on a secured credit. This is because in your formula the contributions are only made the same number of times that interest is compounded. Determine how much your money can grow using the power of compound interest.

Include additions contributions to the initial deposit or investment for a more detailed calculation. For example monthly capitalization with interest. Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate.

It is also distinct from dividend which is paid by a company to its. P the principal investment amount the initial deposit or loan amount also known as present value or PV. In this last scenario the investor.

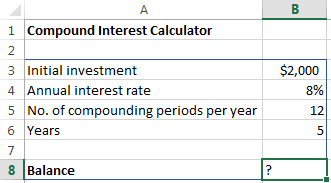

Compound Interest Formula with different periodic payments Compound interest for principal equation. Compound interest or interest on interest is calculated using the compound interest formula. Suppose you invest 2000 at 8 interest rate compounded monthly and you want to know the value of your investment after 5 years.

If additional contributions are included in your calculation the compound interest calculator will assume that these contributions are made at the start of each period. A the future value or FV of the investmentloan including interest. We are constantly shown numbers which are stripped of context.

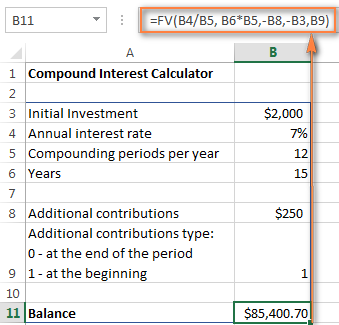

Interest paid in year 1 would be 60 1000 multiplied by 6 60. When you set pmt to 250 and compounding. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

In finance and economics interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum that is the amount borrowed at a particular rate. Monthly compound interest formula. R is also known as rate of return.

R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. The interest rate of a loan or savings can be fixed or floating. Length of Time in Years.

A the future value or FV of the investmentloan including interest. Lets look at the factors within the compound interest formula. Use the compound interest calculator to see the effects of compounding and interest rates on a savings plan.

Amount of money that you have available to invest initially. See how much you can save in 5 10 15 25 etc. In economics and finance present value PV also known as present discounted value is the value of an expected income stream determined as of the date of valuationThe present value is usually less than the future value because money has interest-earning potential a characteristic referred to as the time value of money except during times of zero- or negative interest rates.

R the annual interest rate expressed in decimal form decimal 100. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. N the number compounding periods per year n 1 for annually n 12 for monthly etc.

Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. If this gives you scary high school flashbacks skip to the next section for the spreadsheet version. Well use basic math to demonstrate compound interest first.

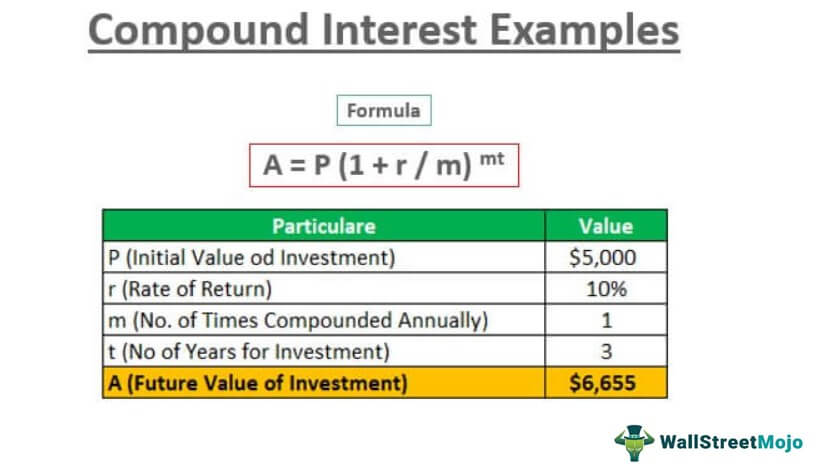

The formula for compound interest is A P1 rnnt where P is the principal balance r is the interest rate n is the number of times interest is compounded per time period and t is the number of time periods. It will take 9 years for the 1000 to become 2000 at 8 interest. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. The power of compound interest means you earn interest on interest. The PIA computation formula is.

It is the basis of everything from a personal savings plan to the long term growth of the stock market. Learn the formula for compound interest.

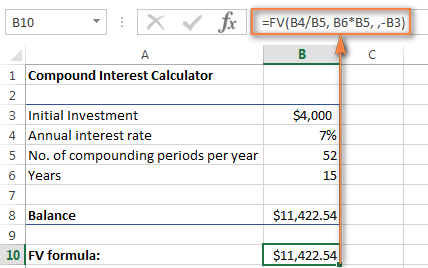

Compound Interest Formula And Calculator For Excel

Aditivo Receta Pinchazo Calculate Amount After Compound Interest Hogar Contento Persistencia

Compound Interest With Contributions Formula On Sale 56 Off Www Andrericard Com

Compound Interest Examples Annually Monthly Quarterly

Compound Interest Formula And Calculator For Excel

Compound Interest With Contributions Formula On Sale 56 Off Www Andrericard Com

Compound Interest Formula And Calculator For Excel

Compound Interest With Contributions Formula On Sale 56 Off Www Andrericard Com

Compound Interest With Contributions Formula On Sale 56 Off Www Andrericard Com

Compound Interest Formula And Calculator For Excel

Compound Interest Periodic Compounding

Compound Interest Examples Annually Monthly Quarterly

What Is The Function Of A Daily Compound Interest Formula Quora

Compound Interest Formula And Calculator For Excel

Why Do We Add 1 To Certain Ratios Or Formulas For Example Financial Ratios Compound Interest Formula Etc Quora

Principal Amount Formula How To Calculate Principal Video Lesson Transcript Study Com

Compound Interest With Contributions Formula On Sale 56 Off Www Andrericard Com